Top 10 Best Payroll Software of 2024 in USA

Introduction

Managing payroll is a critical aspect of running a business, ensuring that employees are compensated accurately and on time. With the ever-increasing complexity of tax laws and regulations, having the right payroll software is essential for efficiency and compliance. In this blog, we will explore the top 10 best payroll software options for 2024 in the United States, each offering unique features to cater to diverse business needs.

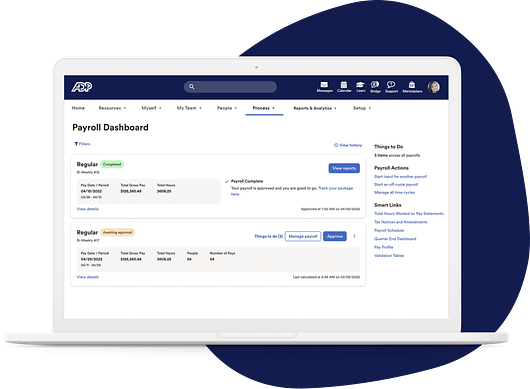

ADP Workforce Now – Payroll Software

ADP Workforce Now is a comprehensive payroll and human capital management (HCM) solution designed to simplify and streamline payroll processes for businesses of all sizes. With a robust set of features and a user-friendly interface, ADP Workforce Now has become a trusted choice for organizations seeking an efficient and reliable payroll software solution.

Key Features:

- Payroll Processing: ADP Workforce Now offers seamless payroll software for processing, and handling everything from calculating employee wages and taxes to generating paychecks and direct deposits.

- Tax Compliance: The Payroll software keeps businesses compliant with ever-changing tax regulations, ensuring accurate withholding and timely tax filings.

- Employee Self-Service: Employees can access their pay stubs, tax documents, and update personal information through a convenient self-service portal, reducing administrative overhead.

- Time and Attendance: The Payroll platform includes time-tracking tools that help manage employee work hours, attendance, and overtime, improving workforce management.

- Benefits Administration: ADP Workforce payroll software now assists with benefits enrollment, tracking, and reporting, making it easier for HR teams to manage employee benefits.

- HR Management: Beyond payroll, the payroll software offers HR functionalities such as onboarding, performance management, and talent acquisition tools.

- Analytics and Reporting: Users can generate custom reports and gain insights into workforce data to make informed decisions.

- Mobile Accessibility: ADP Workforce Now’s mobile app allows users to access essential HR and payroll information on the go.

Pros:

- Comprehensive Solution: ADP Workforce Now combines payroll, HR, and benefits management in one platform, reducing the need for multiple software solutions.

- Scalability: It caters to businesses of all sizes, making it suitable for small startups and large enterprises alike.

- User-Friendly Interface: The payroll software‘s intuitive interface requires minimal training for users.

- Tax Compliance: ADP‘s expertise in tax compliance ensures accuracy and minimizes the risk of costly errors.

Cons:

- Cost: While it offers a wide range of features, ADP Workforce payroll software now can be relatively expensive for small businesses with limited budgets.

- Customer Support: Some users have reported mixed experiences with customer support, citing delays in issue resolution.

In conclusion, ADP Workforce Now is a powerful payroll software solution that goes beyond payroll processing to offer comprehensive HR and workforce management capabilities. Its scalability, tax compliance expertise, and user-friendly interface make it a compelling choice for businesses looking to streamline their payroll and HR processes. However, potential users should carefully consider their budget and support needs before committing to the payroll platform.

Rating: 4.5/5

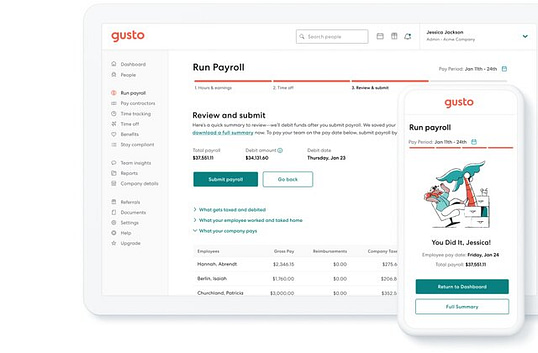

Gusto Payroll Software

Gusto is a trusted name in the world of payroll software, known for its user-friendly payroll platform designed to simplify payroll and HR management for businesses of all sizes. With a focus on automation, accuracy, and compliance, Gusto payroll software has become a popular choice for organizations seeking an efficient payroll solution.

Key Features:

- Seamless Payroll Processing: Gusto payroll software streamlines the entire payroll process, from calculating employee wages and deductions to handling tax filings and generating paychecks.

- Tax Compliance: The payroll software keeps businesses up-to-date with ever-evolving tax regulations, ensuring accurate withholding, reporting, and on-time tax submissions.

- Employee Self-Service: The Gusto payroll platform provides employees with a self-service portal where they can access pay stubs, tax forms, and update personal information, reducing administrative tasks for HR teams.

- Time Tracking: The payroll platform offers time-tracking tools to monitor employee hours, overtime, and paid time off, simplifying time and attendance management.

- Benefits Administration: Gusto payroll software assists with benefits enrollment, tracking, and reporting, making it easier for businesses to manage employee benefits packages.

- HR Management: In addition to payroll, the payroll software includes HR features such as onboarding, document management, and compliance assistance.

- Reporting and Analytics: Users can generate customizable reports and gain insights into payroll and HR data, aiding in informed decision-making.

- Mobile Accessibility: Gusto‘s payroll mobile app allows users to access essential HR and payroll information on the go, enhancing accessibility and flexibility.

Pros:

- User-Friendly: Gusto payroll software is known for its intuitive and easy-to-navigate interface, making it accessible to users with varying levels of technical expertise.

- Affordability: The payroll software offers competitive pricing plans suitable for small businesses and startups.

- Tax Expertise: Gusto‘s tax compliance features help businesses stay compliant with federal, state, and local tax regulations.

- Employee Benefits: Its benefits administration tools simplify the often complex process of managing employee benefits.

Cons:

- Integration Limitations: Some users have reported limitations in integrating Gusto with other HR and accounting software, potentially requiring manual data entry.

- Advanced HR Features: While Gusto payroll software offers essential HR features, businesses with more complex HR needs may require additional software or tools.

In conclusion, Gusto Payroll Software stands out for its user-friendly approach, comprehensive payroll and HR features, and competitive pricing. It simplifies payroll processing and ensures tax compliance, making it a valuable asset for businesses of all sizes. However, users should assess their specific integration and HR requirements to determine if Gusto aligns with their needs.

Rating: 4.7/5

QuickBooks Payroll payroll software

QuickBooks Payroll is a leading payroll software solution that empowers businesses to efficiently manage their payroll and HR needs. With a user-friendly interface and robust features, QuickBooks Payroll simplifies the complexities of payroll processing, tax compliance, and employee management.

Key Features:

- Efficient Payroll Processing: QuickBooks Payroll offers a streamlined payroll process, allowing users to calculate employee salaries, deductions, and generate paychecks seamlessly.

- Tax Compliance: The payroll software stays up-to-date with changing tax regulations, ensuring accurate tax calculations, timely filings, and minimizing the risk of penalties.

- Employee Self-Service: QuickBooks Payroll provides an employee portal where employees can access their pay stubs, tax documents, and update personal information, reducing HR administrative tasks.

- Time Tracking: The payroll platform includes time-tracking features to monitor employee work hours, overtime, and leave, simplifying time management.

- Benefits Administration: QuickBooks Payroll assists in managing employee benefits, including benefits enrollment, tracking, and reporting.

- HR Management: In addition to payroll, the payroll software offers HR functionalities such as onboarding, compliance assistance, and document management.

- Detailed Reporting: Users can generate customizable reports to gain insights into payroll and HR data, facilitating data-driven decision-making.

- Mobile Accessibility: QuickBooks Payroll‘s payroll mobile app allows users to access payroll and HR information on the go, enhancing flexibility and accessibility.

Pros:

- User-Friendly: QuickBooks Payroll is known for its intuitive interface, making it accessible to users with varying levels of technical expertise.

- Integration Capabilities: It integrates seamlessly with QuickBooks accounting software, providing a comprehensive financial management solution.

- Comprehensive Support: QuickBooks offers robust customer support, including live chat, phone support, and a knowledge base.

- Tax Expertise: The payroll software‘s tax compliance features help businesses navigate the complexities of payroll taxes.

Cons:

- Pricing: While QuickBooks Payroll offers various pricing plans, some businesses may find the cost relatively higher compared to other payroll solutions.

- Additional Fees: There may be additional fees for services such as same-day direct deposit or W-2 form processing.

In conclusion, QuickBooks Payroll is a powerful and user-friendly payroll software solution that simplifies payroll processing, tax compliance, and HR management. Its seamless integration with QuickBooks accounting software and comprehensive support make it a valuable tool for businesses seeking a unified financial management system. However, businesses should carefully assess pricing and any additional fees to ensure it aligns with their budget and needs.

Rating: 4.3/5

Paychex Flex Payroll Software

Paychex Flex is a robust and versatile payroll software solution designed to streamline payroll and HR management for businesses of all sizes. With a focus on customization, compliance, and user-friendliness, Paychex Flex has established itself as a trusted partner for organizations seeking a comprehensive payroll software solution.

Key Features:

- Effortless Payroll Processing: Paychex Flex simplifies the entire payroll process, from calculating employee wages and deductions to managing tax filings and issuing paychecks.

- Tax Compliance: The payroll software stays current with changing tax laws and regulations, ensuring accurate tax calculations, timely submissions, and reducing tax-related hassles.

- Employee Self-Service: Paychex Flex provides employees with a user-friendly self-service portal where they can access pay stubs, tax forms, and update personal information, reducing HR administrative tasks.

- Time and Attendance: The payroll platform includes time-tracking features that help businesses monitor employee work hours, attendance, and overtime, enhancing time management.

- Benefits Administration: Paychex Flex assists with benefits enrollment, management, and reporting, simplifying the complexities of employee benefits.

- HR Management: In addition to payroll, the payroll software offers HR functionalities such as onboarding, compliance support, and document management.

- Custom Reporting: Users can generate tailored reports to analyze payroll and HR data, facilitating informed decision-making.

- Mobile Accessibility: Paychex Flex‘s payroll mobile app enables users to access critical payroll and HR information on the go, enhancing flexibility and convenience.

Pros:

- Customization: Paychex Flex offers customizable solutions to cater to the specific needs of businesses, allowing for flexibility in payroll and HR management.

- Comprehensive Support: The payroll software is backed by excellent customer support, including phone support, live chat, and a knowledge base.

- Scalability: Paychex Flex is suitable for small businesses and can grow with a company’s needs, making it adaptable for businesses of varying sizes.

- Tax Expertise: It offers a wealth of tax expertise, helping businesses navigate the complexities of payroll taxes.

Cons:

- Pricing: While Paychex Flex provides a range of pricing options, some businesses may find it relatively costlier compared to other payroll solutions.

- Learning Curve: The extensive features may require some time for users to fully grasp and utilize efficiently.

In conclusion, Paychex Flex is a comprehensive and adaptable payroll software solution that empowers businesses with customizable payroll, tax compliance, and HR management features. Its commitment to customization and comprehensive support makes it a valuable choice for businesses seeking tailored solutions. However, businesses should carefully assess pricing and consider the learning curve when implementing this payroll software.

Square Payroll – Payroll Software

Square Payroll is a modern and user-friendly payroll software solution designed to simplify payroll management for small to medium-sized businesses. With a focus on ease of use, automation, and affordability, Square Payroll offers a comprehensive set of features to help businesses efficiently handle their payroll needs.

Key Features:

- Seamless Payroll Processing: Square Payroll makes payroll processing effortless, from calculating employee wages and deductions to processing payroll and generating paychecks.

- Tax Compliance: The payroll software stays up-to-date with tax regulations, helping businesses accurately calculate and file payroll taxes, and reducing the risk of costly errors.

- Employee Self-Service: Square Payroll provides an employee portal where employees can access their pay stubs, tax forms, and update personal information, reducing HR administrative tasks.

- Time and Attendance: The Payroll platform includes time-tracking features to monitor employee work hours, breaks, and overtime, simplifying time management.

- Benefits Administration: Square Payroll assists with benefits management, including benefits enrollment, tracking, and reporting, streamlining the benefits process.

- Direct Deposit: It offers direct deposit options, allowing businesses to pay employees electronically, improving payment efficiency.

- HR Management: While primarily a payroll solution, Square Payroll offers basic HR features such as employee onboarding and document management.

- Mobile Accessibility: The Square Payroll‘s payroll mobile app enables users to access payroll and HR information on their smartphones, enhancing accessibility and flexibility.

Pros:

- User-Friendly Interface: Square Payroll is known for its intuitive and easy-to-navigate Payroll platform, making it accessible to users with varying levels of technical expertise.

- Affordability: It offers competitive pricing plans, making it an attractive choice for small businesses with budget constraints.

- Tax Expertise: The Payroll software‘s tax compliance features help businesses stay on top of payroll tax obligations.

- Integration Capabilities: Square Payroll integrates seamlessly with other Square products, offering a unified business management solution.

Cons:

- Limited HR Features: While suitable for payroll, Square Payroll‘s HR features are relatively basic and may not meet the needs of businesses with more complex HR requirements.

- Scalability: It is primarily designed for small to medium-sized businesses and may not be the best fit for larger enterprises.

In conclusion, Square Payroll is a user-friendly and affordable payroll software solution that caters to the needs of small and medium-sized businesses. Its focus on simplicity and cost-effectiveness, combined with tax compliance features, makes it an excellent choice for businesses seeking a streamlined payroll solution. However, businesses with complex HR needs or larger-scale operations may need to supplement Square Payroll with additional HR software.

Rating: 4.2/5

Workday – Payroll Software

Workday is a leading payroll software solution that has revolutionized the way businesses manage their payroll and human resources (HR) operations. Renowned for its cloud-based approach, Workday offers a comprehensive suite of features designed to streamline payroll processing, enhance compliance, and empower HR teams.

Key Features:

- Efficient Payroll Processing: Workday simplifies payroll processing by automating calculations, tax withholding, and direct deposits, ensuring accuracy and timeliness.

- Tax Compliance: The payroll software keeps businesses compliant with constantly changing tax regulations, minimizing the risk of errors and penalties.

- Employee Self-Service: Workday payroll software provides employees with a self-service portal, allowing them to access pay information, tax forms, and update personal details, reducing administrative overhead.

- Time and Absence Management: The payroll platform includes robust time-tracking and absence management tools, simplifying time-related tasks and ensuring accurate records.

- Benefits Administration: Workday assists with benefits enrollment, management, and reporting, streamlining the administration of employee benefits.

- HR Management: Beyond payroll, the payroll software offers comprehensive HR features, including recruitment, talent management, and performance evaluation tools.

- Customizable Reporting: Users can create custom reports and dashboards to gain insights into payroll and HR data, facilitating data-driven decision-making.

- Mobile Accessibility: Workday‘s payroll mobile app allows users to access payroll and HR information on mobile devices, enhancing accessibility and flexibility.

Pros:

- Comprehensive HR Capabilities: Workday goes beyond payroll and offers a wide array of HR management features, making it a one-stop solution for HR needs.

- Scalability: It is suitable for businesses of all sizes, from startups to large enterprises, and can adapt to evolving needs.

- User-Friendly Interface: Workday’s intuitive interface ensures that users can quickly navigate and make the most of its features.

- Integration Capabilities: The payroll software easily integrates with other business systems, providing a unified platform for various operations.

Cons:

- Cost: Workday‘s feature-rich payroll platform can come with a higher price tag, which may be a consideration for smaller businesses with budget constraints.

- Implementation Time: Deploying Workday may require some time and effort, particularly for larger organizations.

In conclusion, Workday is a robust and comprehensive payroll software solution that offers an extensive range of HR and payroll features. Its focus on automation, compliance, and scalability makes it an ideal choice for businesses looking to transform their payroll and HR operations. However, businesses should weigh the costs and implementation timeline when considering Workday as a solution.

Rating: 4.4/5

Conclusion

Selecting the right payroll software is crucial for your business’s financial stability and compliance with tax regulations. The top 6 payroll software options for 2024 in the USA listed above cater to various business sizes and requirements. Before making a decision, carefully assess your organization’s needs, budget, and the features that matter most to you. Investing in the right payroll software can save you time, reduce errors, and help you maintain a happy and productive workforce.

Paycom Payroll Software

Paycom is a highly regarded payroll software solution that has earned a reputation for its comprehensive features and user-centric approach to payroll and HR management. This cloud-based payroll platform is designed to streamline payroll processes, ensure tax compliance, and enhance HR operations, making it an indispensable tool for businesses of all sizes.

Key Features:

- Efficient Payroll Processing: Paycom simplifies payroll by automating tasks such as calculating employee wages, deductions, and direct deposits, ensuring accuracy and timeliness.

- Tax Compliance: The payroll software keeps businesses up-to-date with ever-changing tax laws, facilitating accurate tax calculations, reporting, and reducing tax-related risks.

- Employee Self-Service: Paycom offers an intuitive self-service portal for employees, allowing them to access pay information, tax forms, and update personal details, reducing administrative workload.

- Time and Attendance Management: The payroll platform includes robust time and attendance tracking features, simplifying time-related tasks and ensuring precise records.

- Benefits Administration: Paycom assists in benefits enrollment, management, and reporting, simplifying the administration of employee benefits packages.

- HR Management: In addition to payroll, the payroll software offers a comprehensive suite of HR features, including recruitment, talent management, and performance evaluation tools.

- Customizable Reporting: Users can create tailored reports and dashboards to gain insights into payroll and HR data, facilitating data-driven decision-making.

- Mobile Accessibility: Paycom‘s payroll mobile app allows users to access payroll and HR information on mobile devices, enhancing accessibility and flexibility.

Pros:

- Comprehensive HR Functionality: Paycom offers a wide range of HR management features, making it a versatile solution for HR needs.

- Scalability: Suitable for businesses of all sizes, it adapts to evolving business requirements.

- User-Friendly Interface: The intuitive interface ensures users can navigate and utilize the payroll platform effectively.

- Integration Capabilities: Paycom seamlessly integrates with other business systems, providing a unified platform for various operations.

Cons:

- Cost: Paycom‘s feature-rich platform may come with a higher price tag, which could be a consideration for smaller businesses with budget constraints.

- Implementation Time: Implementing Paycom may require a significant investment of time and effort, particularly for larger organizations.

In conclusion, Paycom is a robust and comprehensive payroll software solution that combines efficient payroll processing, tax compliance, and advanced HR features. Its focus on automation, scalability, and user-friendliness makes it an excellent choice for businesses looking to streamline their payroll and HR operations. However, businesses should carefully consider the costs and implementation timeline when evaluating Paycom as a solution.

Rating: 4.5/5

Rippling Payroll Software

Rippling is a cutting-edge payroll software solution that has garnered attention for its innovative approach to payroll and human resources (HR) management. This cloud-based payroll platform is designed to simplify and automate payroll processes, ensure tax compliance, and empower businesses to efficiently manage their HR needs.

Key Features:

- Effortless Payroll Processing: Rippling streamlines payroll by automating calculations, tax withholding, and direct deposits, ensuring accuracy and timeliness.

- Tax Compliance: The payroll software keeps businesses compliant with dynamic tax regulations, minimizing the risk of errors and penalties associated with payroll taxes.

- Employee Self-Service: Rippling provides employees with a user-friendly self-service portal, enabling them to access pay information, tax forms, and update personal details, reducing HR administrative tasks.

- Time and Attendance Management: The payroll platform includes robust time and attendance tracking features, simplifying time-related tasks and ensuring precise records.

- Benefits Administration: Rippling assists in benefits enrollment, management, and reporting, simplifying the administration of employee benefits packages.

- HR Management: Beyond payroll, the payroll software offers comprehensive HR features, including recruitment, onboarding, talent management, and performance evaluation tools.

- Customizable Reporting: Users can create tailored reports and dashboards to gain insights into payroll and HR data, facilitating data-driven decision-making.

- Mobile Accessibility: Rippling’s mobile app allows users to access payroll and HR information on mobile devices, enhancing accessibility and flexibility.

Pros:

- Comprehensive HR Capabilities: Rippling goes beyond payroll and offers a wide array of HR management features, making it a one-stop solution for HR needs.

- Scalability: It is suitable for businesses of all sizes and can adapt to evolving business requirements.

- User-Friendly Interface: Rippling boasts an intuitive interface, ensuring users can quickly navigate and make the most of its features.

- Integration Capabilities: The payroll software easily integrates with other business systems, providing a unified platform for various operations.

Cons:

- Cost: Rippling‘s advanced features may come with a higher price point, which may be a consideration for smaller businesses with budget constraints.

- Implementation Time: Implementing Rippling may require dedicated time and effort, particularly for larger organizations.

In conclusion, Rippling is an innovative and comprehensive payroll software solution that combines efficient payroll processing, tax compliance, and advanced HR features. Its focus on automation, scalability, and user-friendliness makes it an ideal choice for businesses looking to streamline their payroll and HR operations. However, businesses should carefully consider the costs and implementation timeline when evaluating Rippling as a solution.

Rating: 4.3/5

Zenefits Payroll Software

Zenefits is a renowned payroll software solution that offers a user-friendly and comprehensive approach to payroll and human resources (HR) management. With a cloud-based payroll platform, Zenefits empowers businesses to streamline payroll processes, ensure tax compliance, and efficiently handle HR tasks.

Key Features:

- Efficient Payroll Processing: Zenefits simplifies payroll by automating calculations, tax deductions, and direct deposits, ensuring accuracy and timeliness in payroll execution.

- Tax Compliance: The payroll software stays current with ever-changing tax regulations, helping businesses accurately calculate and file payroll taxes, reducing tax-related risks.

- Employee Self-Service: Zenefits provides employees with a convenient self-service portal, allowing them to access pay information, tax forms, and update personal details, minimizing HR administrative tasks.

- Time and Attendance Management: The payroll platform includes robust time and attendance tracking features, simplifying time-related tasks and ensuring accurate records.

- Benefits Administration: Zenefits assists with benefits enrollment, management, and reporting, streamlining the administration of employee benefits packages.

- HR Management: Beyond payroll, the payroll software offers comprehensive HR features, including recruitment, onboarding, performance management, and compliance tracking.

- Customizable Reporting: Users can create tailored reports and dashboards to gain insights into payroll and HR data, facilitating data-driven decision-making.

- Mobile Accessibility: Zenefits offers a payroll mobile app that allows users to access payroll and HR information on mobile devices, enhancing accessibility and flexibility.

Pros:

- Comprehensive HR Capabilities: Zenefits offers a wide range of HR management features, making it a versatile solution for businesses with diverse HR needs.

- Scalability: Suitable for businesses of various sizes, it adapts to changing business requirements.

- User-Friendly Interface: Zenefits is known for its intuitive interface, ensuring that users can navigate and utilize its features effectively.

- Integration Capabilities: The payroll software seamlessly integrates with other business systems, providing a unified platform for various operations.

Cons:

- Cost: Zenefits‘ advanced features may come with a higher price tag, which could be a consideration for smaller businesses with budget constraints.

- Implementation Time: Implementing Zenefits may require dedicated time and effort, particularly for larger organizations.

In conclusion, Zenefits is a comprehensive and user-friendly payroll software solution that combines efficient payroll processing, tax compliance, and advanced HR features. Its focus on automation, scalability, and user-friendliness makes it an excellent choice for businesses looking to streamline their payroll and HR operations. However, businesses should carefully consider the costs and implementation timeline when evaluating Zenefits as a solution.

Rating: 4.2/5

BambooHR Payroll Software

BambooHR is a reputable payroll software solution that stands out for its user-friendly interface and comprehensive approach to payroll and human resources (HR) management. This cloud-based payroll platform is tailored to simplify payroll processes, ensure tax compliance, and enhance HR operations, making it an essential tool for businesses of all sizes.

Key Features:

- Efficient Payroll Processing: BambooHR streamlines payroll by automating calculations, tax deductions, and direct deposits, guaranteeing precision and timeliness in payroll execution.

- Tax Compliance: The software keeps businesses informed about ever-evolving tax regulations, assisting in accurate tax calculations and filings, thus minimizing tax-related risks.

- Employee Self-Service: BambooHR offers a convenient self-service portal for employees, enabling them to access pay information, tax forms, and update personal details, thereby reducing HR administrative tasks.

- Time and Attendance Management: The platform encompasses robust time and attendance tracking features, simplifying time-related responsibilities and ensuring accurate records.

- Benefits Administration: BambooHR facilitates benefits enrollment, management, and reporting, simplifying the administration of employee benefits packages.

- HR Management: Beyond payroll, the software provides an extensive array of HR features, including recruitment, onboarding, performance management, and compliance tracking.

- Customizable Reporting: Users can generate tailored reports and dashboards to gain insights into payroll and HR data, facilitating data-driven decision-making.

- Mobile Accessibility: BambooHR offers a payroll mobile app, enabling users to access payroll and HR information on mobile devices, thus enhancing accessibility and flexibility.

Pros:

- Comprehensive HR Capabilities: BambooHR offers a wide spectrum of HR management features, making it a versatile solution suitable for businesses with diverse HR requirements.

- Scalability: It is adaptable to businesses of varying sizes, seamlessly adjusting to evolving business needs.

- User-Friendly Interface: BambooHR is celebrated for its intuitive interface, ensuring that users can navigate and harness its features effectively.

- Integration Capabilities: The software seamlessly integrates with other business systems, providing a unified payroll platform for various operations.

Cons:

- Cost: BambooHR‘s advanced features may be associated with a higher price point, which might be a consideration for smaller businesses with budget constraints.

- Implementation Time: Implementing BambooHR may require dedicated time and effort, particularly for larger organizations.

In conclusion, BambooHR is a comprehensive and user-friendly payroll software solution, uniting efficient payroll processing, tax compliance, and advanced HR features. Its emphasis on automation, scalability, and user-friendliness renders it an excellent choice for businesses seeking to streamline their payroll and HR operations. Nevertheless, businesses should carefully assess the costs and implementation timeline when evaluating BambooHR as a solution.